Put a gold backed IRA in your golden retirement

A: To be eligible for a gold IRA rollover, you must have a traditional IRA or a Roth IRA. Our experience with each company was positive overall. Ultimately, you are responsible for your financial decisions. What to look out for: Lear Capital’s set up fees are on the higher side. By taking the time to research the loan lender, you can ensure that you are getting the best gold IRA rollover services available. Choose offshore storage such as Cayman Islands, Canada or Singapore if you want your gold out of the US government’s reach multiple companies offer offshore storage. Precious metals do carry distinct advantages, such as stability, but they also have distinct disadvantages, such as illiquidity. However, you can choose to work with these custodians or different ones. Funds received from an IRA are not subject to penalty or taxation as long as they are deposited into your new IRA account within 60 days.

OKX Price Predictions: Don’t Miss Out On UwerxWERX For The Biggest Gains Of The Year

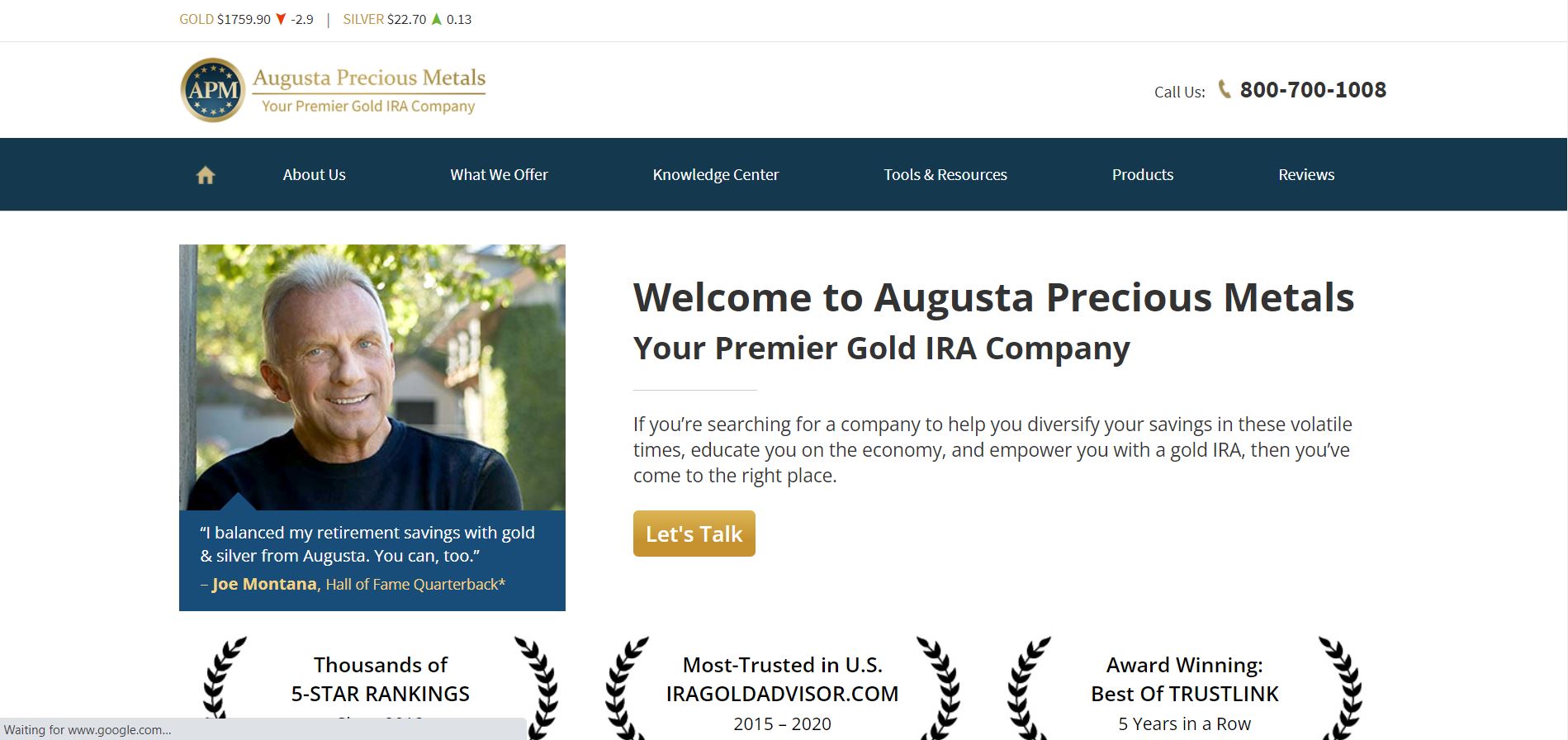

Example 2: When gold trades at $1,250 an ounce, Jenny Brown invests $25,000 in a gold backed ETF. Gold IRA Physical Possession. If you can make the required minimum investment and are interested in retirement savings or precious metals, you should put Augusta Precious Metals at the top of your list of gold firms to get in touch with. Investing in gold for gold iras retirement is a wise choice for many individuals. Discover the Power of Advantage Gold: Unlock Your Lottery Winning Potential. Finding the ideal custodian for your gold IRA storage can be daunting. There are a few different types of IRAs, but one of the most popular is the gold IRA. This education may be delivered directly through professionals and company agents or indirectly through informational materials. 500’s list of the fastest growing private companies in America. IRA Nickel Account: 0. So, you can save more money if you go with Regal Assets instead of another gold IRA company. IRS rules for precious metals IRAs state that the precious metals must be shipped to an approved IRA depository. Noble Gold: Good for smaller gold investments. Gold might feel comforting amid market fluctuations, but some experts caution against putting all eggs in one basket when it comes down solely to gold IRAs.

What is a 401k and How Does it Work?

A: To begin investing in a Gold IRA, follow these steps. Get started with Advantage Gold. Here are some of the key benefits of investing in gold for retirement. Gold Australian Saltwater Crocodile. When researching gold IRA reviews, it is important to look for any negative feedback. Has high customer ratings and positive reviews. We hope we answered the questions you may have about a Gold IRA investment.

Conclusion Best Gold IRA Companies

If you are holding the fund for less than 3 years, then the capital gains will be taxed as per your income tax slab rate. The CEO of Augusta Precious Metals Isaac Nuriani has been running the company since graduating from UCLA with a Bachelors in Economics since 2012. A gold IRA rollover is a great way to diversify a retirement portfolio and protect it from inflation. These guidelines frequently form the basis for the extra costs linked to these investments. Yes, you can open a new IRA with a contribution and your annual contribution limit remains the same. While there are many benefits to investing in gold, it is important to remember that it is not a risk free investment.

What is the difference between allocated and unallocated gold?

Investing in a gold IRA can be a great way to save for retirement and gain a secure financial future. If you choose to ignore this rule and keep your gold at home, your gold will qualify as a distribution, meaning that you may face a 10% tax penalty. A Gold IRA is no different than any other IRA. The gold itself must meet set levels of fineness. Some of the companies that were in contention but could not make it into the top ten include Lear Capital, Strata Trust, Orion Metal Exchange, and Red Rock Secured. However, one thing to look out for is that set up costs, storage fees, and custodial fees can also be on the higher end for gold IRAs. With precious metals IRAs, investors also have the option of rolling over their existing 401k or 403b accounts. However, most traditional retirement investment accounts do not allow you to invest in gold. Birch Gold Group separates itself from the pack through its honesty and frankness in dealing with customers. The best part is that these flat fees are charged on all types of accounts irrespective of the account size. These include rollovers for 403bs, thrift savings plans, savings accounts, and IRAs. To learn more about them, read the in depth review I did on them here. The company’s philosophy is to offer customers a simple and easy way to invest in gold IRA accounts.

1 GoldCo: Best for Secure Gold Investments

If a salesperson is overly aggressive, it may be an indication that you should reconsider your decision. IRA Precious Metals Elite Account – 6. Additionally, American Hartford Gold offers financial planning services, making it easy for investors to develop a comprehensive investment strategy that meets their long term goals. Customers can get help with diversifying their assets to defend against inflation and economic turmoil. Distribution and use of this material are governed byour Subscriber Agreement and by For non personal use or to order multiple copies, please contactDow Jones Reprints at 1 800 843 0008 or visit. I’ve yet to come across a gold company dedicated to educating its clientele as Augusta Precious Metals does.

Conclusion Gold IRA Custodians

How do you choose the right gold investment company. They offer a wide range of gold and silver IRA options, and their knowledgeable team of professionals is available to answer any questions and provide guidance. Gold IRAs typically hold gold coins, gold bars, and other forms of gold bullion such as American Eagle coins, Canadian Maple Leaf coins, and South African Krugerrand coins. This form only takes about five minutes to complete. Tina K rated 5 stars on Google. Best at Home Gold IRA. This means that they are always accessible no matter the time zone that the client lives in. With non segregated storage, your precious metals are stored with the precious metals of other investors in the same vault. If you want to keep up with precious metal prices, American Hartford Gold can help you do just that. It can be challenging to get a clear picture of how much you’ll pay in fees, especially as even the best gold IRA companies are reluctant to disclose their fees on their website. Unlike traditional assets such as stocks and bonds, gold provides diversification and acts as a reliable hedge. There have been times in the past when people have had their valuables seized from safety deposit boxes by the FBI and other government organizations. Your gold IRA company can help you choose a creditable custodian and storage facility — and act as a liaison to help you understand and manage the details.

>> Visit American Hartford Gold

Oxford Gold Group sells gold, silver, platinum, and palladium coins and bars that you can include in your IRA. Mobile Gaming has become a popular form of entertainment for people worldwide. Lear Capital has been in the precious metals business for nearly a quarter of a century and has served over 91,000 customers in that timeframe. Away from athletic podiums, gold is turned into valuable jewelry and represents luxury and quality. How Much Does It Cost to Start a Gold IRA. With over a billion active users, it has become the go to app for visual. Next up in our exploration of the best gold IRA companies is American Hartford Gold. For 50 years, we’ve been turning natural resources into energy for people and progress for society. American Hartford Gold specializes in creating physical precious metals IRAs for investors looking to protect against turbulent times for generations but they also work with clients that are looking to make individual purchases of gold and silver to have discreetly delivered to their doorstep.

Oxford Gold: Cons Best Gold IRA Companies

If funds make up most of your portfolio, you’ll need to be aware of the fees involved. American Hartford Gold Pros and Cons. By the end of this article, you will have a better understanding of the best Gold IRA companies to consider for your investment needs. With knowledgeable staff and straightforward fees, Lear Capital is a great choice for those looking to invest in gold. However, when it comes to investing in gold, it is important to find a reliable broker or custodian to ensure the safety of one’s investments. With these three companies, however, customers who have invested their gold IRAs with them before all had great things to say, which only added to the already stellar reputations. Patriot Gold Club is a top tier gold IRA custodian, recognized for its superior customer service and expertise in gold investing. These metals have shared properties and are often found in the same mineral deposits. For example, they’ll guide and educate you about gold IRAs so that you know exactly what you’re doing when you invest with them. Variety of products, including coins, bars, and rounds. Most financial advisors recommend limiting gold to a small portion of a balanced portfolio. When it comes to investing in gold, many investors prefer to use a gold based IRA. Gold IRA reviews can help potential investors understand the different types of gold that can be held in an IRA. Customers who are interested in investing should consult with a licensed professional investment advisor.

Contact Information

You must store the precious metal that backs your IRA in a special depository, so it’s like buying gold without possessing it. Yet, this could be the year when gold sees quite a jump in value. Gold Alliance is a trusted provider of gold and silver IRAs. Gold IRAs are a specific type of self directed IRA that allows you to invest in physical gold and other precious metals like silver, platinum and palladium. We do not allow opaque clients, and our editors try to be careful about weeding out false and misleading content. STRATA works with Delaware Depository, which is a nationally recognized depository for the safekeeping and storage of our clients’ precious metals. >Before investing in a precious metals IRA, there are several factors to consider to determine if it’s the right investment choice for your financial situation. With these three companies, however, customers who have invested their gold IRAs with them before all had great things to say, which only added to the already stellar reputations. They have over ten years in the industry, and their leadership has a combined experience of decades. > Get a Free Web Conference With Their Harvard Economist. Silver is also a popular choice for a precious metals IRA due to its affordability and accessibility.

Tax Benefits

Strategizing with this company ensures you will have a lot less to worry about, as you will find 95% of the work is done for you. By including gold in your IRA, you can reduce your overall risk and protect your nest egg from market volatility. They should also be able to explain why investing with their company is the right move as opposed to other companies in the same industry. “Augusta Precious Metals. So by having gold in your portfolio, you can protect yourself against potential losses without sacrificing returns or liquidity. There is no one size fits all answer to this question, as the number of precious metals you should include in your IRA will depend on a variety of factors, such as your overall investment goals, risk tolerance, and financial situation. This fee is much lower than that charged by other firms.

Silver IRAs

This is one of the lowest requirements in the industry. However, many investors find that the benefits of gold investing make these higher fees worth the cost. In fact, you don’t even have to limit yourself to only to thsoe gold IRAs. Investor direct pricing can help you save a lot on commission fees. Augusta Gold and Platinum IRA Annual Interest Rate: 4. The RMD for each year is calculated by dividing the account balance of your IRA as of December 31st of the previous year by your life expectancy. As a company, they’ve worked for the country’s largest precious metal investment corporations, gaining extensive expertise in the sector. What would be the reason why you would rather go through the hassle of setting up a precious metal IRA. Gold IRAs, for instance, are becoming popular because they offer a hedge against inflation that other investments cannot.

CONS:

The same is true for palladium and platinum. Its value is solely what people will pay for it based on macroeconomic factors and plain old supply and demand. Despite higher minimum investment requirements, their positive ratings across various review platforms make it clear they’re doing something right. That will not include the fees you incur whenever you buy and ship precious metals. You’ll pay zero in management fees, but you’ll have to account for IRA set up fees and depository storage fees. When looking for the best gold IRA companies, it is important to research and compare their offerings. You’ll also benefit from the convenience of being able to invest online without having to leave home or visit a physical location. Lear Capital Best for Rare and Collectible Coins. Base your decision on your own research and comparisons and less on testimonials. Institutional Solutions. When it comes to investing in gold, it is important to find the best gold IRA custodian to help you manage your retirement savings.

Recent News

I ranked them based on their reputation and level of service to customers. In conclusion, the gold IRA companies that rose to the top of the rankings were those that consistently provided excellent customer service, competitive fees, and secure storage options. Investors have always relied on gold and silver during periods of economic uncertainty. Consider how easy it is to withdraw your savings when you have a gold IRA account or any other type of precious metal IRA including silver, platinum, and palladium. Here’s what we like most about Augusta Precious Metals. For instance, gold bullion bars are regulated products that contain a specified gold weight. Why would you want your gold outside of your own country. Provides access to industry experts for investment advice. To help you find the best gold IRA company, we’ve reviewed the top precious metals IRA companies in the industry. View All December 2020 Newsletter Edition. Birch Gold Group is a precious metals IRA provider established in 2003. The process of ranking gold IRA companies involves looking at customer feedback, fees, policies, and other factors to determine which companies are the best.

Learn More

Discover the Benefits of Investing with Noble Gold Today. Please find all IRA contribution details on these IRS links. Investing in mutual funds or exchange traded funds ETFs that focus on gold can be a simpler and less expensive approach. In addition, Augusta provides all the information you need about your gold and silver purchases, working in your direction to grow your precious metals portfolio, overseeing buybacks, and fulfilling other precious metals requirements. Aside from transparency, Augusta Precious Metals offers a money back guarantee if you are unsatisfied with their work. Gold IRAs are becoming increasingly popular among investors due to their potential to provide a safe haven from volatile markets and rising inflation. To learn more about our policies on this matter, please call 1 800 300 0715 Ext. When it comes to investing in a gold IRA, selecting the right gold IRA custodian is crucial to ensure the safety and legitimacy of your investment. This guide is updated for 2023 and includes a wealth of resources to help you be a more informed investor. Gold Freedom and Hope coins. The price will depend on which custodial service you choose.

2 What type of metals should I have with my Birch Gold Group Gold IRA?

GoldCore offers to buy back your gold or silver at very competitive prices. All three firms have a long history of providing excellent service to retirement investors. The company stands out for its top notch customer service, competitive pricing, and a wide selection of gold products. The American Hartford Gold Group is a gold investment company that specializes in helping clients secure their financial future through gold investments in IRA accounts. The educational portal also ranks among the best with plentiful articles, downloadable pdfs, and Youtube videos. It supports rollovers from several accounts, including traditional IRAs, Roth IRAs, thrift savings plans, 401ks, 403bs, and 457 plans. Gold IRAs are specialized individual retirement accounts that hold precious metals, such as gold, silver, platinum, or palladium. Why would you want your gold outside of your own country. You can choose to purchase precious metals directly from the company. While gold coins and bullion are the standard options for a self directed IRA, many offer investment options in precious metals such as silver, platinum, and palladium. Diversifying one’s investment portfolio with precious metals is a smart move, especially for securing wealth against market volatility. The Better Business Bureau awarded Goldco an A+ rating. GoldCo’s team of experienced professionals are dedicated to helping clients make the best decisions when it comes to investing in gold.

Subscriptions

Not only do they have low resources and upfront costs, but they also have a team of gold IRA experts to help you get started. Investing in gold is often seen as a way to protect your financial future. It is important to check with your local financial regulatory body to understand any rules or restrictions that may apply. Bars are identified by size, refinery and serial number for example: 100 oz. When you fund your gold IRA, the company will store your gold bullion in a certified depository in Delaware or Texas. 🕿 1 800 355 2116@ Burbank, CA. Because we understand the risks, we have worked so diligently to provide you with extensive information. Historical Chart Center. Gold IRA companies usually offer buyback programs that enable you to cash out when you want to liquidate your precious metals holdings. Gold Alliance is a top rated gold IRA company for its superior customer service, knowledgeable staff and wide selection of gold IRA options. The Bloomberg Barclays US Aggregate Bond Index is a broad based flagship benchmark that measures the investment grade, US dollar denominated, fixed rate taxable bond market.

Best Gold IRA Investment Companies for 2023Best Gold IRA Investment Companies for 2023

Platinum IRA Account: 2. It’s best if their transactions and processing are quick because you don’t want to waste your time. Currently, Augusta Precious Metals has an A+ rating from the Better Business Bureau and an AAA rating from Consumer Alliance. High minimum purchase requirements. Call Our Trusted Experts Today. Invest in Your Future with Gold Alliance: A Trusted Precious Metals IRA Company. Additionally, it is used in groundwater treatment, medicine, jewelry, dentistry, and certain chemical processes. Liberty Head Double Eagle. Experience the Quality of Oxford Gold Group. This process includes filling out an agreement that will make you an official custodian. They can also give you tips on avoiding schemes and scams that might compromise the retirement savings you’ve worked on for years. It is important to look for companies that have a good track record and a history of customer satisfaction.